With more companies staying private longer, there’s more wealth than ever to capture in private markets.

StashAway Reserve is your access....

Private Equityl

Access high-growth private companies through diversified multi-manager private equity strategies for enhanced returns.

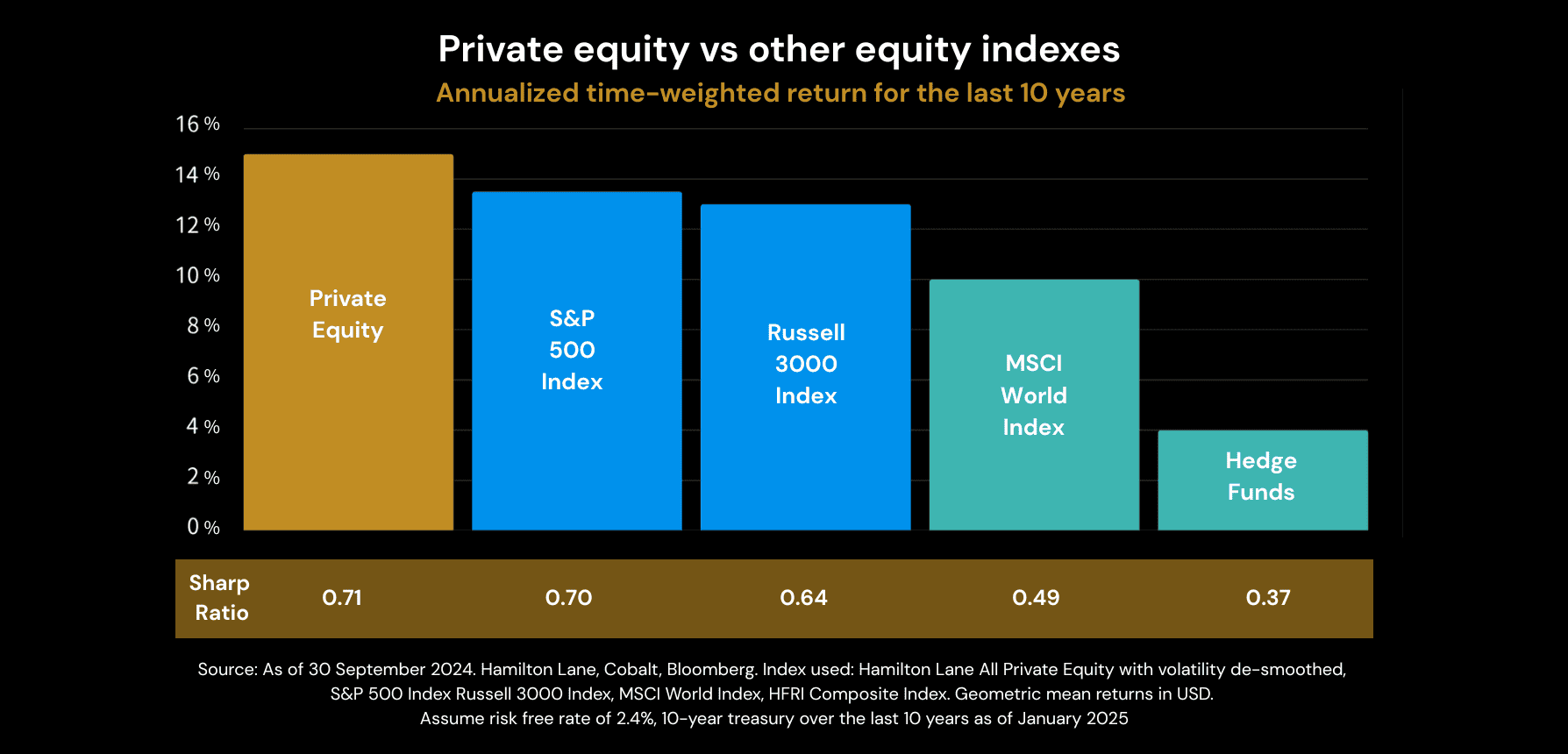

Exceptional performance: Private equity, as an asset class, has outperformed public equities across global major markets over the last 25 years.

Accessible entry point: Start with a lower minimum subscription amount than traditional private banks.

Reduce volatility:Private equity investments are less correlated with the public market and create diversification benefits to your portfolio.

Transparency:Invest with no hidden fees and no upfront fees.

*Source: StashAway, Bloomberg, Burgiss

Private Credit

Receive stable, enhanced yields with low volatility through senior secured private credit strategies.

High yield potential:Private credit as an asset class provides attractive risk-adjusted returns, filling the gap between equity and traditional corporate bonds.

Accessible entry point: Start with a lower minimum subscription amount than traditional private banks.

Enhanced portfolio diversification: Private credit investments exhibit lower correlation to public equity and bond markets.

Transparency: Invest with no hidden fees and no upfront fees.