Your genuine wealth partner

With StashAway Reserve, access highly personalised wealth advisory, and private investment opportunities. This is the new league of wealth creation.

We’re licensed by the Securities and Futures Commission of Hong Kong (CE No. BQE542)

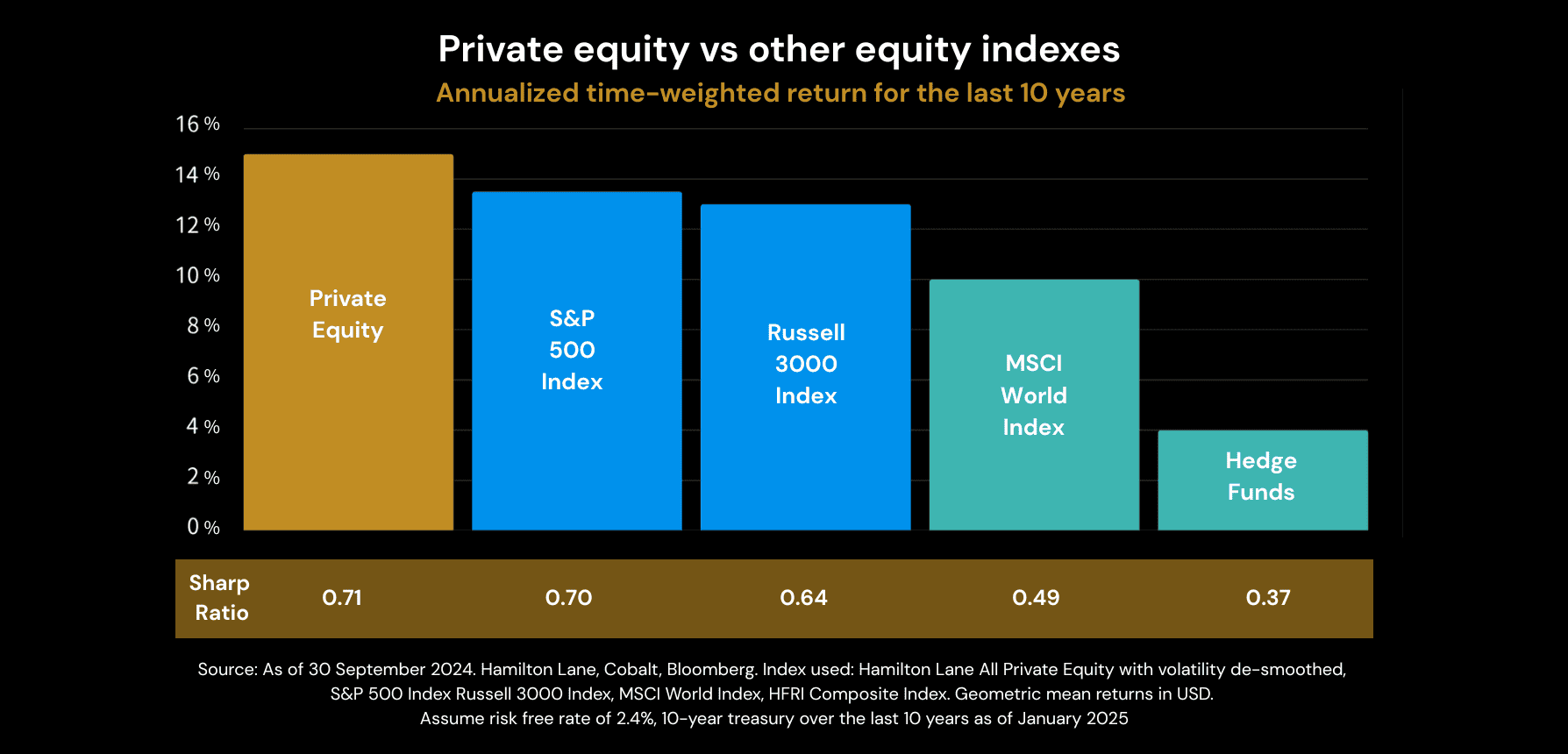

With more companies staying private longer, there’s more wealth than ever to capture in private markets.

StashAway Reserve is your access....

Private Equity

Private Credit

Get access to Wealth Advisory centred around you

Our SFC-licensed Wealth Advisors provide comprehensive financial and investment advice. You can count on unbiased insights - after all, we don’t believe in commissions on products. Instead, Reserve is all about impartial financial guidance so you can make informed decisions that align with your interests.

Here are some of the benefits you enjoy as a Reserve client:

- Yearly financial planning sessions to create and maintain your financial plan: Longevity is core to the Reserve experience - it’s not just about wealth creation but sustainable financial health. In your personalised financial planning session, we understand your unique reality and deliver you a financial plan that evolves as you do.

- Bi-annual portfolio reviews: Our in-depth reviews give you full transparency on past performance and current events impacting your investments. This way, you always know exactly where your portfolio stands and can make informed decisions about its future.

- Access for a chat at any time for any question: Reserve’s wealth advisory is set up to take whatever shape serves you best - whether that’s a regular communication cadence or an ad-hoc check-in as the markets move, your wealth advisor is always just a message away.

Start building your wealth differently

Everything is accessible with a touch of your fingertips on your mobile app.

Frequently Asked Questions

What is StashAway Reserve?

StashAway Reserve is a private wealth management offering. With Reserve, clients can choose from a wide range of wealth advisory services and access private investments.

How do I qualify for Professional Investor status?

As an individual, you can qualify as a Professional Investor, if you are a individual investor having a portfolio of not less than HK$8 million (or its foreign currency equivalent) at the relevant date in:

- A portfolio on your own account; or

- A portfolio on a joint account with your associate (eg. spouse); or

- Your share* of a portfolio on a joint account with another who is not his associate; or

- A portfolio of a corporation which has the holding of investments as its principal business and is wholly owned by you.

* In determining your share of a portfolio on a joint account with persons other than your associates, your share means the one specified in a written agreement among the account holders OR an equal share of portfolio in the absence of an agreement.

Assets can be:

- Investments based on market value (including stocks, bonds, unit trusts, equity-linked investment and more)

- Certificates of Deposits (CDs)

- Cash or cash equivalent deposits

Please upload documents such as:

- One or more statements of accounts issued by a bank or brokerage firm (either in your name or with your spouse or your children on a joint account basis), dated not more than 3 months ago

- A certificate issued by an auditor or certified public accountant, dated not more than 3 months ago

- A public filing# submitted by or on behalf of the individual, dated not more than 3 months ago

- A copy of the agreement (if any), in cases where your share of a portfolio on a joint account with persons other than your associates is concerned.

# Public filing means a document that a person or body is under a duty to publish pursuant to legal or regulatory requirements in Hong Kong (e.g. published financial results of a listed company etc.)

Please note: pursuant to the Securities and Futures Commission of Hong Kong, you are required to provide such supporting documents on an annual basis to renew your Professional Investor status.

How do I become a Reserve client?

To become a Reserve client, you have to invest $ 1,000,000 HKD with StashAway. This amount can be in any of StashAway’s portfolios.